Long-term Assets, also called Non-Current Assets, are assets a business intends to hold for more than one year.

The opposite of Long-Term assets are Short-term Assets or Current Assets. Current Assets are those that a business intends to convert into cash in the short-term – usually in the current operating cycle or the next 12 months.

Inventory is an example of a current asset. This is because a business typically plans to convert inventory into customer cash as soon as possible. Other current assets are Cash, Cash Equivalents and Receivables.

Long-term assets or Non-Current assets, on the other hand, have a useful file longer than the current operating or accounting cycle and are generally used to provide economic benefit throughout their useful life.

Typically, Long-term assets are less liquid than Short-term or Current Assets.

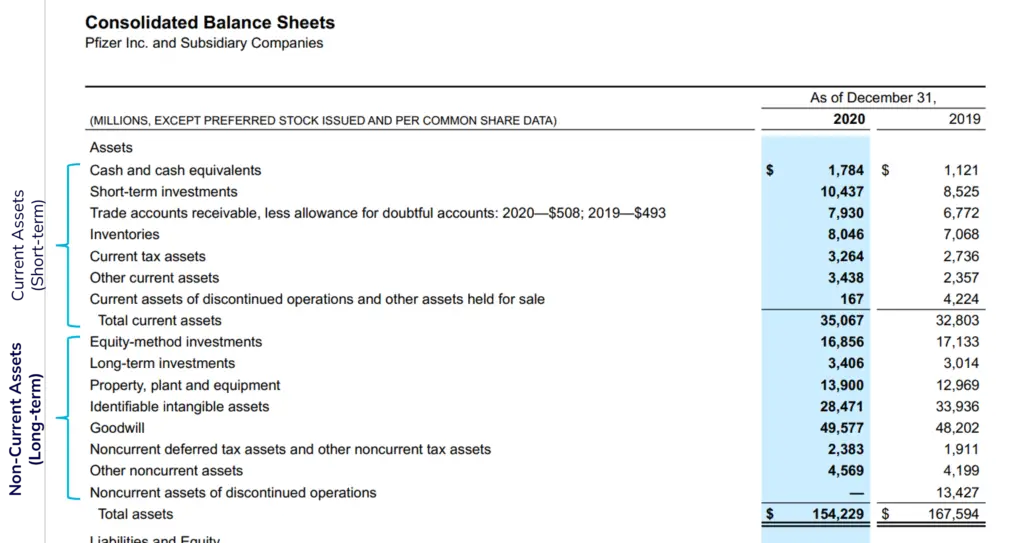

Long-term assets on the Balance Sheet

A Balance Sheet shows a company’s Assets, Liabilities and Owner’s equity.

The Assets section shows both the Short-term or Current Assets and the Long-term or Non-current assets.

Here’s how they appear on Pfizer’s Balance Sheet.

You’ll notice that the Long-term Assets can be assets that are Real as well as Financial.

Property, Plant and Equipment are Real Assets. They are tangible. We can touch them.

The Equity-method investments are Financial Assets. These are intangible.

The key difference between these two types of Long-term Assets is Depreciation.

While most Long-term Assets can be depreciated, some, like land or investments, cannot be depreciated.

Long-term assets & Depreciation

Depreciation is the accounting practice of spreading an asset’s acquisition cost over its useful life.

The portion of a long-term asset’s cost which is expensed in the current fiscal year is called its Depreciation Expense. This is shown on the Income Statement.

Depreciation reduces a long-term asset’s value from one year to the next until the end of the asset’s useful life. The asset’s value is recorded in the Balance Sheet.

Long-term assets can be depreciated so long as they are held to produce an income and so long as they naturally lose value over their useful life.

Examples of Long-term Assets

Common long-term assets include:

- Property, Plant and Equipment – This includes machinery, factories, equipment, vehicles, computers, etc.

- Long term investments – Stocks, bonds, etc.

- Intangible assets – patents, copyrights, trademarks, goodwill, etc.

Long-term Assets are usually the result of large investments like a new factory, expensive equipment, a building, etc. and so can often constitute a significant portion of a company’s asset base.

Key Takeaways

- Long-term Assets are also called Non-current Assets.

- They are held by a business for a period longer than one operating cycle and at least greater than 12 months.

- Long-term Assets are generally the result of large investments in the long-term future of a business and include tangible assets like buildings, machinery, equipment, vehicles and computers as well as intangible assets like investments, patents, copyrights, trademarks and goodwill.

- Most tangible Long-term assets can be depreciated but some, like Land, cannot.