The quick answer:

Yes. Inventory is a current asset.

Inventory is a current asset because companies hold inventories with the intention of converting them into cash through sales, within the current fiscal year or less than 12 months.

To understand this concept more, let’s start with some of the basics.

What is a Current Asset?

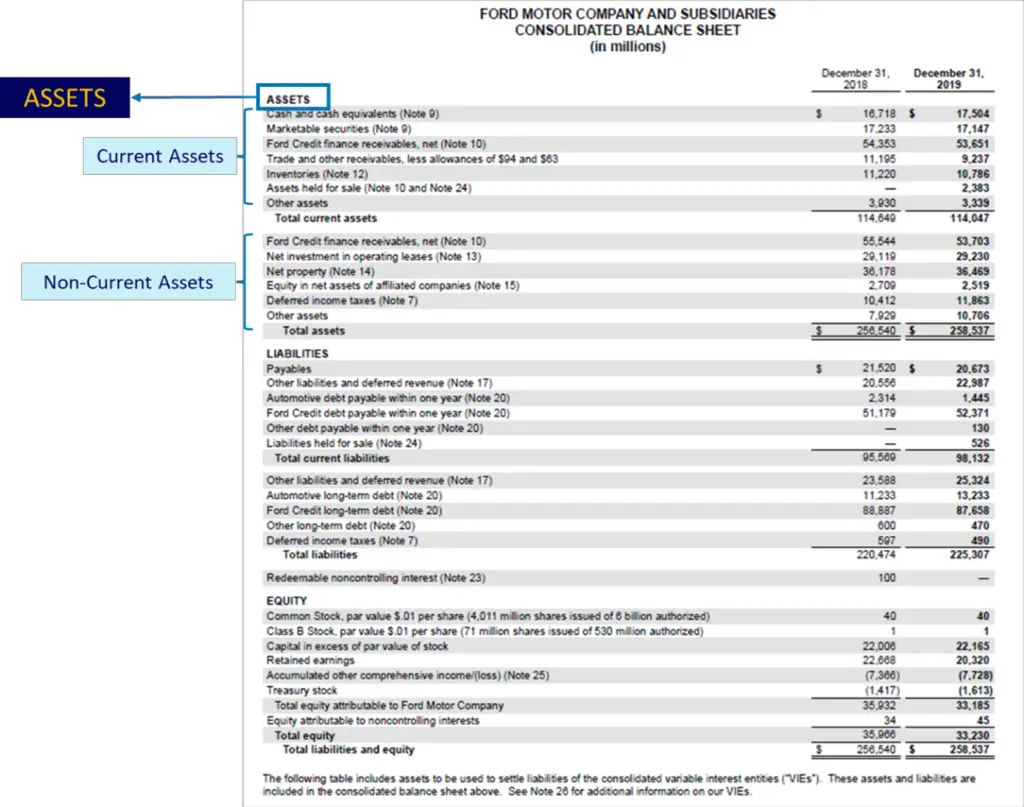

Below you’ll see the Balance Sheet of Ford Motor Company.

The Balance Sheet is one of the key financial statements of any company. It is a snapshot taken at a specific point in time (eg at the end of a fiscal year) that shows the company’s Assets, Liabilities and Owner’s Equity.

Assets can either be Current Assets or Non-current Assets.

Source

Non-current Assets

Non-current Assets are those which the company does not plan to liquidate within the next 12 months. Examples are Land, Trademarks, Patents, Long-term investments, Equipment, etc.

Current Assets

Current Assets, on the other hand, are those which the company expects to convert into cash within the next 12 months.

Current Assets include items like Cash & Equivalents, Accounts Receivables, Short-term investments, Prepaid Expenses and …. Inventory!

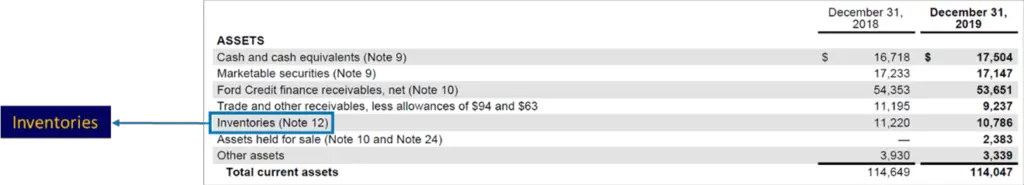

Source

For many companies, Inventory represents one of the largest assets on the balance sheet.

Inventory can include raw materials, parts, components, work-in-progress/unfinished products and finished products.

It represents money invested in the business, but which has yet not been converted into profit through sales to customers.

In other words, this money is “stuck” in the business.

This is why one of the primary objectives of inventory management is to reduce the amount of money locked in inventory and improve the business’s free cash flow position.

Why is Inventory a Current Asset?

As we’ve seen a Current Asset is an asset which the company expects to convert into cash within the next 12 months.

We’ve also seen that Inventory can include finished and unfinished products (including raw material).

A company would definitely have the intention of converting unfinished products into finished products and selling these finished products within the next 12 months.

And this is why Inventory is a Current Asset.

Now, mind you, even though Inventory is a Current Asset it is one of the least liquid of Current Assets.

Cash is the most liquid Current Asset.

Cash Equivalents are right behind.

Short-term investments by their very definition are those which the company plans to liquidate in the short term.

Accounts Receivables will be collected (in theory at least) from the customer within a short period.

In contrast to all of the above, Inventory gets converted to cash only if the business manages to sell it to a customer. And that could take time.

Still, this is expected to happen in the next 12 months, thus making Inventory a Current Asset.

Depreciation and Inventory

A commonly asked question is: “Since Inventory is an asset, can it be depreciated?”

The answer is: “No.”

Depreciation

Depreciation is the process of reducing the value of an asset on your books from one fiscal year to the next until the end of the useful life of the asset.

For instance, you may depreciate a laptop over 3 years because you may decide that you need to change a laptop every 3 years.

Similarly, you may depreciate machinery in the factory over 10 or more years because that’s how long the useful life of machinery is.

As you can see assets are depreciated only if they lose their value as they age from one year to the next. In other words, these are Non-Current Assets.

But as we have seen earlier in this article, Inventory is a Current Asset. This means it is expected that a business gets rid of it within 12 months of its appearing on the books.

And that is why Inventory cannot be depreciated.

Note that while most non-current assets like laptops, machinery, equipment and vehicles can be depreciated, not all non-current assets are depreciable. For instance, Land cannot be depreciated because it does not lose value over time.

Inventory write-down

Now, Inventory can be written down. This can be done when the inventory loses value.

Let’s say there’s a theft in your store. You will then write down the value of the inventory based on the value of the lost items.

Or let’s say that you carry food as inventory. If some of the food does bad and you can’t sell it, you can do an inventory write-down for the value of the food that cannot be sold.

However, this should not be confused with depreciation where the value of a non-current fixed asset is reduced at fixed intervals based on well-accepted, standard accounting rules.

Inventory write-downs are done the moment the inventory loses its value. This is distinct from depreciation since depreciation can be accumulated.

Key Takeaways

- Inventory is a Current Asset since companies that hold inventory do so with the intention of converting it into cash through sales within 12 months

- Other Current Assets include Cash & Equivalents, Accounts Receivables, Short-term investments and Prepaid Expenses.

- One of the goals of Inventory Management is to reduce the amount of money stuck in inventory.

- Inventory cannot be depreciated based on generally accepted accounting rules, but you can write it down when it loses value.