Earnings before Interest and Taxes or EBIT is a key profitability metric used to measure the performance of a company or to compare the operational performance of different companies.

EBIT is synonymous with Operating Profit as it shows a company’s profits from operations taking into account large, long-term investments the company may have made.

Together with EBITDA, Net Profit and the lesser-known EBIDA, it is an important financial measure of a company’s performance.

Topics

Here’s what we’ll cover in this article.

- What is EBIT?

- The EBIT Formula: How to calculate EBIT

- EBIT Margin (Operating Margin)

- EBIT Vs EBITDA

- EBIT Vs Net Profit

- Shortcomings of EBIT

- Key Takeaways

What is EBIT?

EBIT stands for Earnings before Interest and Taxes.

EBIT shows us a company’s profitability from its operations and its large depreciable, capital investments.

Unlike the EBIDA or the EBITDA, EBIT takes Depreciation and Amortization into consideration.

So, EBIT is a measure of profitability before considering the impact of Interest and Taxes but after considering the impact of Depreciation and Amortization.

This makes EBIT a very useful metric to gauge the profitability of companies that have large capital investments (factories, land, buildings, machinery) or which invest heavily in R&D, software development, etc.

Such companies have a significant Depreciation and Amortization expense in the current fiscal year and so EBIT – which takes Depreciation and Amortization into account – is a good metric to measure their profitability from operations.

Calculating EBIT: the EBIT Formula

There are two ways to calculate EBIT.

The first starts with the Gross Profit and subtracts Operating Expenses from it.

The other starts with the Net Profit and adds Interest and Tax expenses to it.

We’ll look at both.

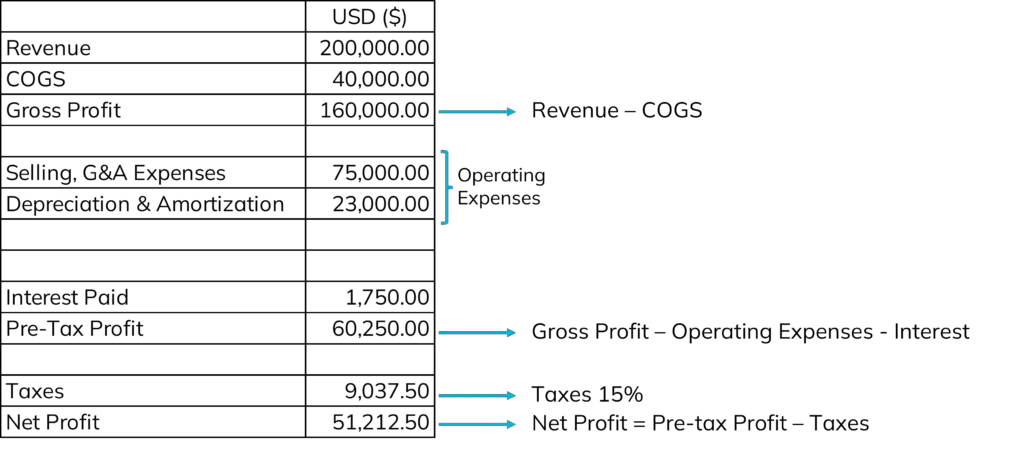

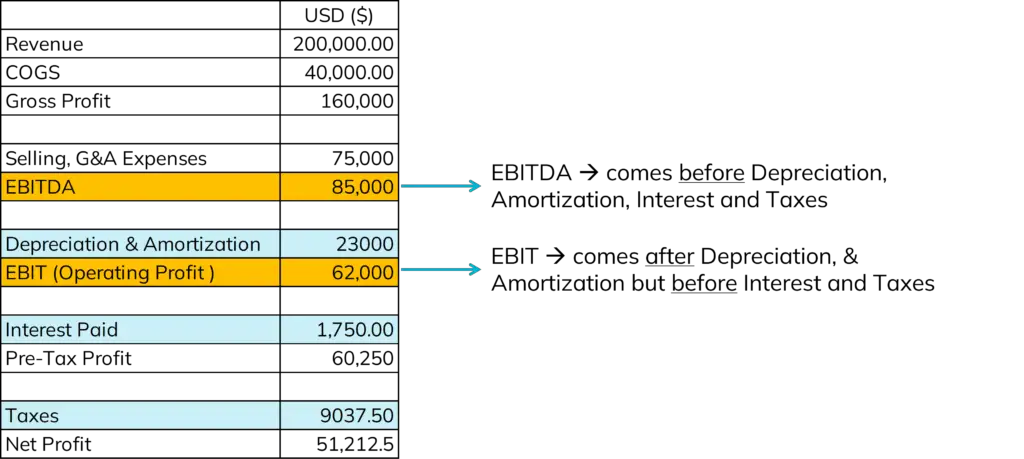

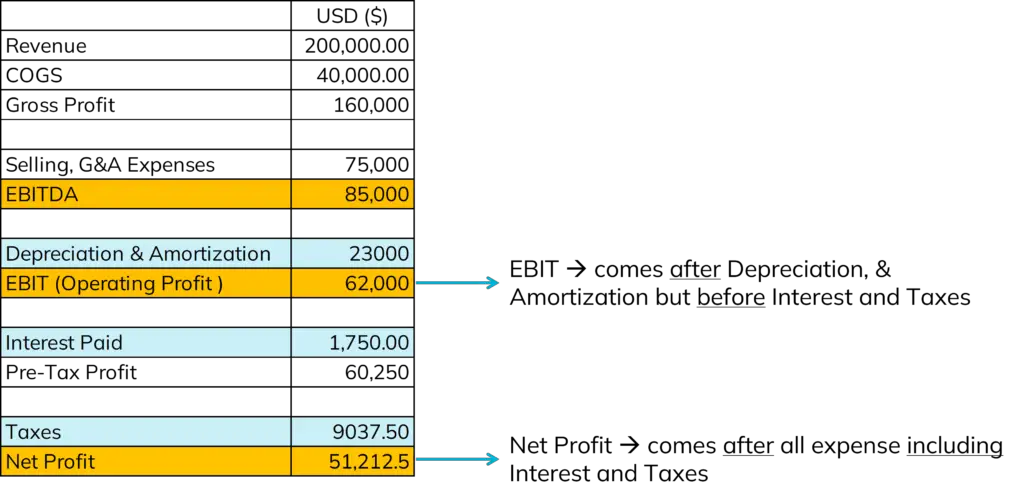

Let’s start with a simplified Income Statement that we’ve made for this example.

In this example:

- The Revenues for the year are $200,000.

- The Cost of Goods sold is $40,000.

- This gives a Gross Profit of $160,000

- Selling and General & Administration Expenses are $75,000

- Depreciation & Amortization is $23000

- Interest Expense is $1750

- This gives a Pre-Tax Profit of $60,250.

- Let’s say the company pays an effective tax of 15% which gives $9037.5 in taxes.

- So Net Profit will be: $51,212.5.

EBIT Formula 1:

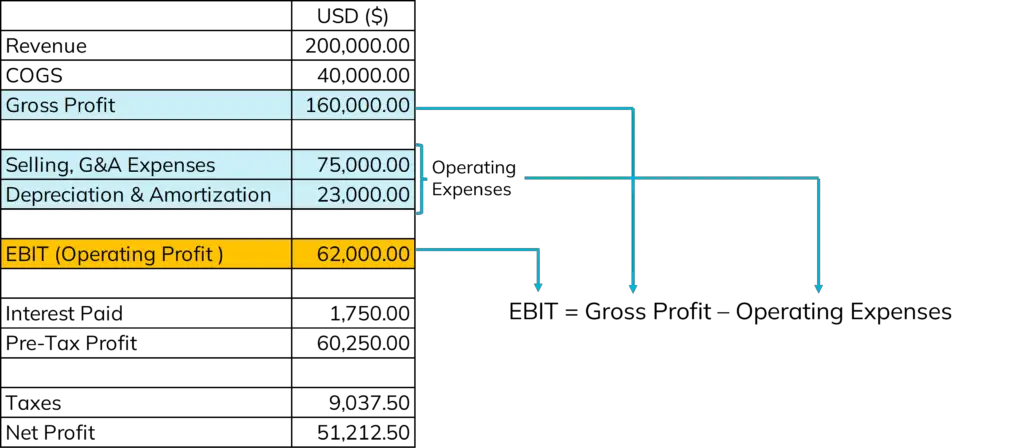

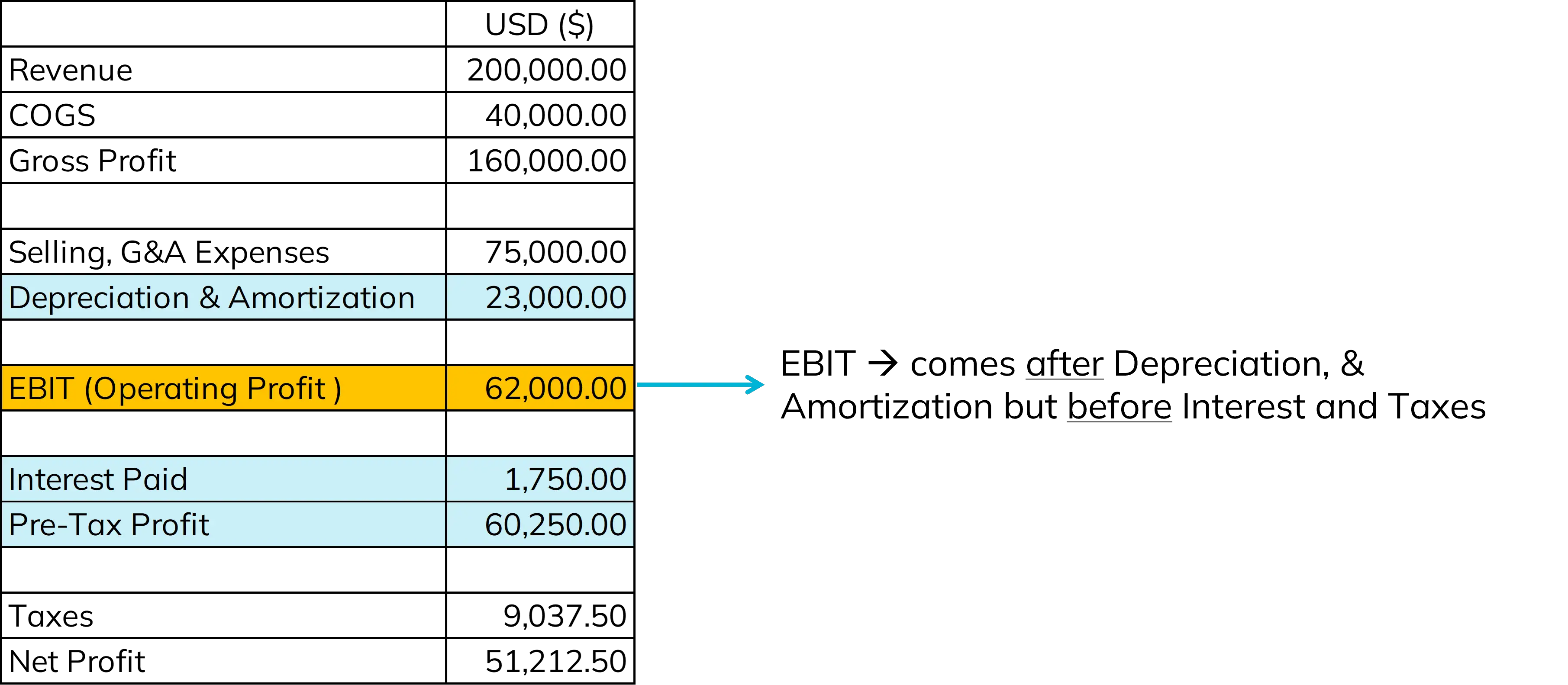

We know that EBIT stands for Earnings before Interest and Taxes but after Depreciation and Amortization.

So, in the Income Statement, we insert a line item for EBIT after Depreciation and Amortization but before Interest and Taxes.

Then we can calculate EBIT as follows.

EBIT = Gross Profit – Operating Expenses (Selling, G&A and D&A)

So,

EBIT = $160,000 – $75,000 – $23,000

EBIT = $62,000

EBIT Formula 2:

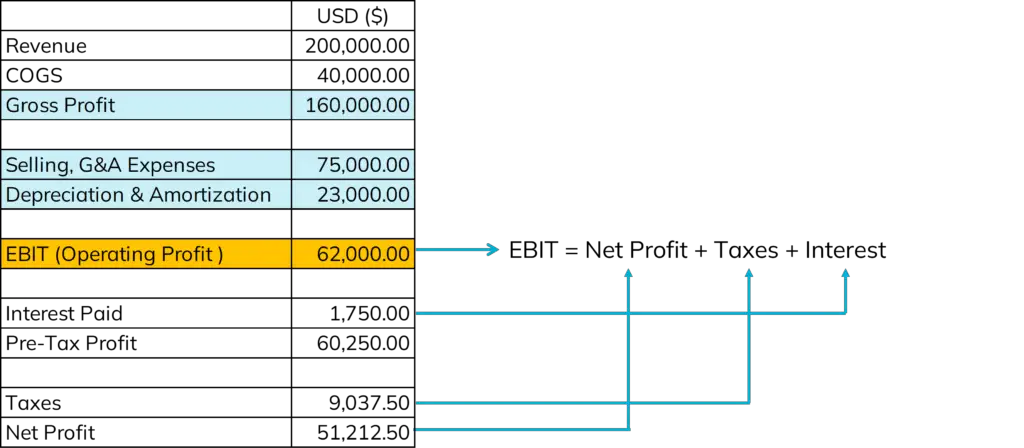

The other way to calculate EBIT is to start with the Net Profit.

In this formula:

EBIT = Net Profit + Taxes + Interest Expense

So,

EBIT = $51,212.50 + $9037.5 + $1750

EBIT = $62,000

EBIT Margin (Operating Margin)

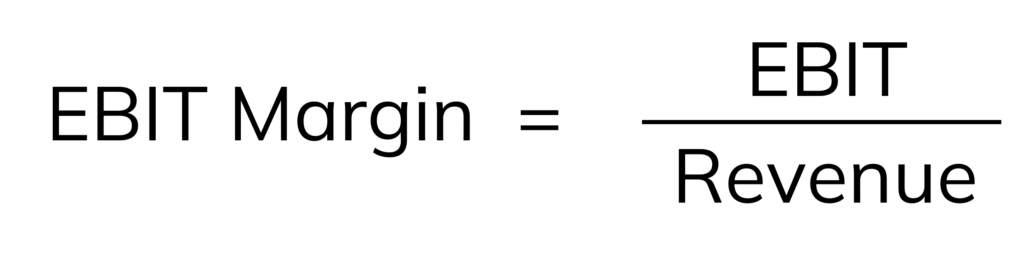

EBIT Margin, also called Operating Profit Margin, gives us the relationship between Revenue and EBIT.

The formula for EBIT Margin is:

EBIT Margin = EBIT divided by Revenue

The EBIT Margin helps us understand a company’s ability to generate profits from every dollar of sales that it brings in.

EBIT Margin does not tell us how much profit the company makes (rather that’s what EBIT is) but instead gives us a ratio which we can use to compare the relative performances of companies in the same industry.

Let’s say that there are two companies which roughly have the same revenue but one of them spent way more on infrastructure like factories, buildings, plant and equipment.

Then a comparison of the EBIT margins (which takes Depreciation and Amortization into account) of both companies will clearly show that the company that spent less on infrastructure, is generating more profit for every dollar of revenue and therefore is healthier.

EBIT Vs EBITDA

Both EBIT and EBITDA are commonly used metrics to measure the profitability and performance of companies.

However, for certain Capex intensive businesses, looking at just one and not the other can prove to be misleading as these two metrics may paint completely different pictures of the same company.

Let’s see how that could happen.

EBIT, as you now know, stands for Earnings before Interest and Taxes, but after Depreciation and Amortization.

EBITDA, however, stands for Earnings before Interest and Taxes, and before Depreciation and Amortization.

Impact of large depreciable investments

So, as you see in the Income Statement below, Depreciation & Amortization, Interest and Taxes come after EBITDA.

But Depreciation & Amortization come before EBIT while Interest and Taxes come after.

So, if a company has a significant Depreciation & Amortization expense, the EBITDA can be a misleading metric as it would give an inflated sense of the company’s profitability.

A sounder metric, in that case, would be EBIT which takes Depreciation & Amortization expense into account.

EBIT Vs Net Profit

Net Profit is the profit after all expenses. That makes Net Profit the real bottom line.

While all other types of earnings are useful to measure performance or compare the operating performance of different companies, Net Profit is what is technically available for disbursement to shareholders. And so, in one sense, it is the only true metric of a business’s profitability.

Impact of Debt Financing

If a company finances its business with a significant amount of debt, it’s probable that it has a large annual interest payment to make.

In such a case, simply using EBIT to gauge its overall financial health will be insufficient as EBIT ignores the Interest expense.

Net Profit will be a better metric.

(However, if you do not want to keep taxes out of the picture, use the Pre-Tax Profit number)

Comparing companies in different tax jurisdictions

EBIT also ignores the impact of taxes.

This means if you’re comparing two companies in the same industry but in different countries, then EBIT won’t give you the complete picture because the tax expense can be significant.

(This assumes that both companies are profitable and therefore have taxable income).

Let’s say you are reviewing a company in the United States and a comparable company in the same industry in Germany.

To compare their operational performances, you could use either the EBITDA or the EBIT. Both these metrics will ignore the impact of debt financing and taxes.

Or you could compare Pre-tax profit, in which case you can compare the entire operational performance of both companies (including debt financing) by ignoring the tax impact.

But corporate tax rates in the United States are very different than those in Germany.

So, to truly compare the profitability of both companies, your best bet is going to be the Net Profit value as this will take all expenses into account, including the tax expense.

Shortcomings of EBIT

- If a company has a large amount of debt financing and so has significant interest payments, EBIT can be a misleading measure of profitability. It may make the company look more profitable than it is.

- EBIT also doesn’t help in comparing companies in different industries especially if in one industry requires large depreciable investments and the other doesn’t.

EBIT takes Depreciation and Amortization into consideration. And so, the company without the large depreciation expense may appear better healthier and managed than the company with the large depreciation expense.

But this may not be the case. A better metric would be the EBITDA which strips out the Depreciation and Amortization. - EBIT is also not ideally suited to compare companies in different tax jurisdictions since it does not take the tax expense into consideration.

Key Takeaways

- EBIT stands for Earnings before Interest and Taxes.

- EBIT is calculated after Depreciation, & Amortization but before Interest and Taxes.

- Unlike EBITDA, EBIT takes Depreciation, & Amortization into account. Therefore, considers the impact of large depreciable investments like factories, land, building, machinery, etc.

- EBIT can be calculated in one of two ways:

- EBIT = Gross Profit – Operating Expenses

- EBIT = Net Profit + Taxes + Interest Expense

- EBIT = Gross Profit – Operating Expenses

- EBIT Margin gives us the relationship between Revenue and EBIT. The EBIT Margin is an indication of a company’s ability to generate profit from every dollar of sales.

- EBIT ignores the Interest Expense and so relying on the EBIT to judge a company’s profitability can be misleading if the company relies heavily in debt financing. Similarly, EBIT ignores the Tax Expense and so if a company operates in a high corporate tax environment, EBIT could give us an incomplete picture of the company’s performance.